Monday.com is soaring since its initial public offering. In only two months the company’s value has more than doubled. Monday.com’s share price was up yesterday by 23.55% at $302.78, giving the company a market cap of $13.24 billion.

When Monday.com went public in June the company issued 3.7 million shares and raised $574 million. At the time, shares sold for $155 each, much higher than the originally announced price range of $125 to $140. Salesforce.com Inc.’s venture arm and Zoom Video Communications Inc., each agreed to buy $75 million the company’s shares in a private placement at IPO price, according to Monday.com’s filings.

The company’s surge can be attributed to much better earnings than expected for Q2 2021. Revenue was $70.6 million, an increase of 94% year-over-year. The expectations were for just $62.1 million.

Net cash used in operating activities was negative $0.4 million, with negative adjusted free cash flow of $1.5 million, compared to negative net cash used in operating activities of $13.9 million and $15.0 million of negative adjusted free cash flow, in the second quarter of 2020.

Cash, cash equivalents, short-term deposits and restricted cash was $878.0 million as of June 30, 2021, including $21 million from borrowings under our revolving credit facility, and net proceeds from our IPO and concurrent private placement of $736.2 million.

–

[embedded content]

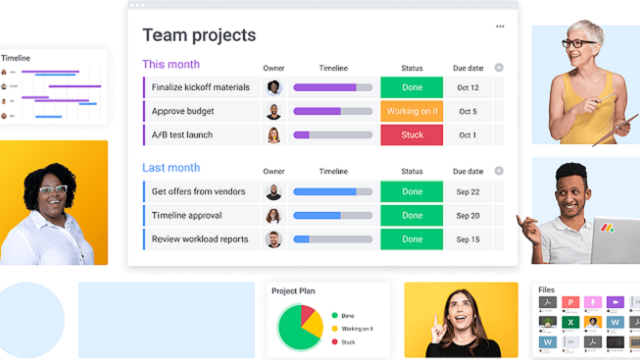

In addition to the above, Monday.com recently released monday workdocs, a completely new capability to monday.com Work OS, which enables organizations to take document collaboration to new levels. Documents are the starting point for work and monday workdocs is a completely new style of connected documents that are built to support collaboration, with live objects that update in real time whenever their source of data changes.

The company states that the introduction of monday workdocs is a significant opportunity to provide its customers with new ways to create no-code, low-code software and expand how monday.com is adopted across organizations of all sizes.

Monday also launched the free tier of monday.com, limited to two users. The free offering is designed to increase our market opportunity by driving awareness and broader adoption among a new set of audiences.

And the company also had some well known new customer wins or expansions during the quarter, including Headspace, Wellington-Altus Private Wealth, Mintel, and Adyen. New strategic alliances were also announced with Global Systems Integrators across key industries such as manufacturing and real estate including Hitachi Solutions and NTT-Data.

Founded in 2012, the Tel Aviv based Monday.Com specializes in project management, team management, SaaS, communication, production tracking, team collaboration, and work management. The company offers a team management platform.

Saas and cloud services are ever more important now due to the Covid-19 crisis. The Corona Virus pandemic has forced countless people away from their offices leaving them with a greater need for secure, efficient and simplistic services such as these.

“We delivered strong results in our first quarter as a public company, as strong execution and expanding adoption of monday.com Work OS drove total revenue growth of 94%. We are pleased with the momentum in our business that demonstrates continued high growth at scale,” said monday.com founder and co-CEO, Roy Mann. “monday.com Work OS is the leader in the low-code no-code market, and our business is accelerating as we continue to expand platform usage into use cases such as operations, project management, CRM, finance, marketing, HR, and IT,” said monday.com founder and co-CEO, Eran Zinman.