The Fear Of Missing Out (FOMO) is likely to drive financial markets significantly higher in the coming weeks, predicts the CEO of one of the world’s largest independent financial advisory organizations.

The Fear Of Missing Out (FOMO) is likely to drive financial markets significantly higher in the coming weeks, predicts the CEO of one of the world’s largest independent financial advisory organizations.

The prediction from Nigel Green, founder, and chief executive of deVere Group, which has $12 billion under advisement, comes as global stocks scored significant gains on Wednesday.

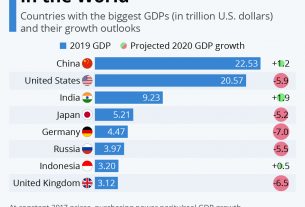

Benchmark stock indexes in the U.S. – the world’s largest economy – gained 2.9 percent on the day, bringing the total gains since the market bottomed out last month to an impressive 31 percent for the S&P 500 index.

Elsewhere, the FTSE100 in London closed at its highest in seven weeks, echoing upswings on European and Asia-Pacific indexes.

Mr. Green says: “We’re witnessing what is likely to become a powerful recovery in global stock markets as investors look ahead to the latter half of 2020 and into 2021.

“They are shrugging off the entirely expected current poor economic data – this has largely been priced in already.

“Instead, investor optimism is being reinforced by reports of major progress in the effort to develop coronavirus treatments. Also as central banks continue to roll out and further enhance their stimulus packages, and as crippling lockdown restrictions around the world begin to ease to revive economies.”

He continues: “With investors gaining confidence, a V-shaped post-pandemic economic revival is now being priced in.

“Investor exuberance is contagious. As the markets move steadily higher – unfazed by the recent poor economic data from the peak of the pandemic – it can be expected that the uptick will further sharpen due to that powerful investor sentiment: FOMO.

“The Fear Of Missing Out will drive many investors – including myself – off the sidelines.

“With recovery on its way, they don’t want to miss out on the current value in the market long-term, which has the effect of driving markets higher.”

At Wednesday’s closing bell, the S&P 500 index, Wall Street’s benchmark, had clawed back 60 percent of the losses suffered through February and March. This says, Nigel Green, illustrates the trend he describes.

“Investors know that the closer we get to a COVID-19 drug, and the more economies are reopened, and as trillions and trillions from stimulus packages kick in, the more the rebound will take hold – and they don’t want to miss the boat.”

The deVere CEO concludes: “A bit like this invisible virus, we don’t know what’s going to happen day by day, but we do know ultimately economies adapt and so do people.

“This is why, as history teaches us, that over the longer-term the performance of stock markets is fairly predictable: they go up.”

Read more about: deVere Group, Nigel Green