By Richard Cox

Against the U.S. dollar, the Israeli shekel has shown a great deal of resilience in the face of unprecedented macroeconomic uncertainties. In part, this strength may have been due to supportive stimulus measures enacted by the nation’s central bank. However, this positive outlook for the Israeli shekel is based largely on the underlying strength present in the country’s economic data (as we will see in the economic statistics cited below). As a result of these trends, market valuations for the closely watched USD/ILS currency pair have fallen as low as 3.5299 in recent sessions. Overall, this activity indicates strength in the Israeli shekel, as well as a resumption of the currency pair’s prior downtrend en route to what could be new lows in the market.

Chart Analysis: Author, TradingView

For the Israeli shekel, these are the highest valuations since the beginning of March, so this trend has extended from periods that preceded the widespread economic effects of the COVID-19 pandemic. Similar trends have been present in the value of the shekel against the euro, with the ILS/EUR currency pair rising to 0.2612/€ in recent sessions.

On April 21st, 2020, the Bank of Israel established the exchange rate between the shekel and the U.S. dollar to trade at a level -0.78% lower (relative to the previous session) while the exchange rate between the shekel and euro was lowered even further (by -1.13%). However, what might be most critical about these trends is the fact that the Israeli shekel has emerged from the COVID-19 pandemic uncertainties as a preferred safe-haven currency amongst global investors.

In most cases, the U.S. is viewed as the preferred safe-haven, which is not surprising because the greenback still operates as the world’s reserve currency of choice. However, it would appear that the dramatic death toll in the United States is already weighing on the country’s GDP growth prospects while unemployment levels have surged beyond those present during the Great Depression.

In spite of the U.S. dollar’s reputation as a globally accepted safe-haven instrument, the shekel has consistently appreciated against the greenback and this poses some significant questions going forward. Will the shekel continue to maintain these trends if analyst expectations for worldwide GDP growth plummet further?

The Israeli shekel is currently trading at its strongest levels against the U.S. dollar since the beginning of March, and this is partially due to the fact that the outlook for Israel’s economy has improved now that prior lockdown measures have been eased. Additionally, a new government (with a stated primary focus on national unity) has recently been formed and this may have improved the outlook for the country after nearly two years of political uncertainty.

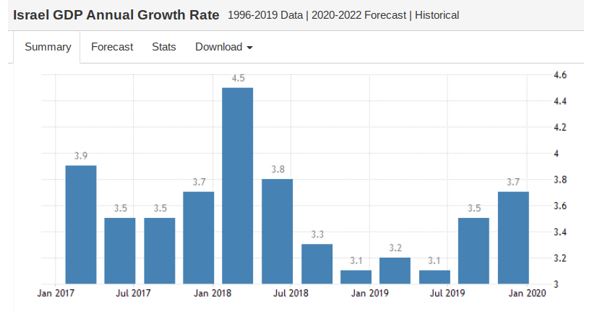

Source: Trading Economics, Central Bureau of Statistics Israel

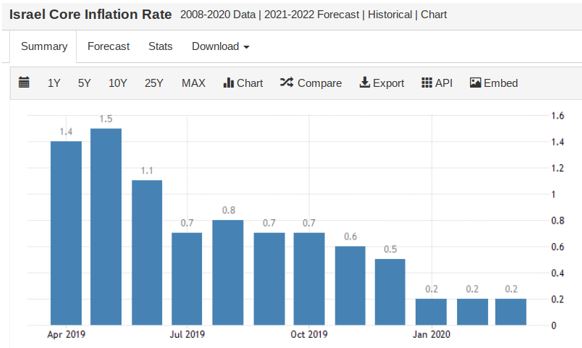

Source: Trading Economics, Central Bureau of Statistics Israel

Ultimately, the country’s underlying economic reports will be what matters most and recent trends in Israel’s GDP figures suggest a booming financial environment is already in place. Examples of these improving business trends include recent decisions that have been made by Google to launch new Israel programs and build on the country’s rising reputation as a leading hotspot for innovative business startups.

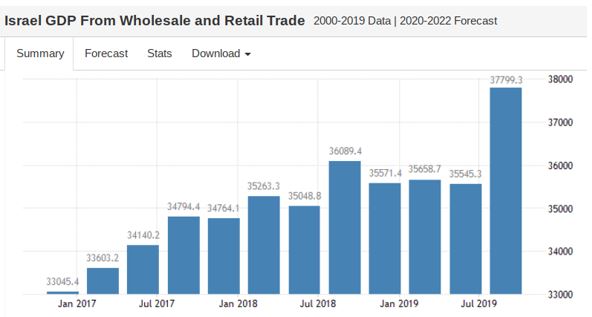

Lior Noy, corporate head of startup growth and leadership at Google, has made comments which explained: “This is a program for start-ups that are beginning their growth period or have growth challenges,” and this gives financial analysts firm reason to believe that Israel’s impressive trends in startup businesses are likely to continue. As a result of these trends, particularly notable performances have been seen in the wholesale and retail trade sectors, which rose to 37799.3 million shekels during the third quarter of 2019 (up from 35545.3 million shekels during the previous quarter).

Source: Trading Economics, Central Bureau of Statistics Israel

Broader GDP growth rates are more subdued, but they still show significant room for expansion. During the fourth-quarter period of 2019, Israel’s GDP output rose by 3.7% (on an annualized basis). Since this growth rate is still far below the performances seen in the early parts of 2018, it stands to reason that these figures can continue to grow in spite of potential economic weakness that might materialize once global lockdown restrictions begin to normalize around the world.

Source: Trading Economics, Central Bureau of Statistics Israel

At the same time, Israel’s core consumer price figures suggest that inflation is unlikely to become a problem in Israel. Of course, consumer inflation has become a real problem in global terms, given the fact that supply chains have been disrupted to an unprecedented extent. Fortunately, it looks like Israel might be shielded from these negative effects due to the stable trends in consumer price activity that were already in place. In March, Israel’s core inflation rate rose by just 0.2% (on an annualized basis), which is highly encouraging for the nation.

One area that could potentially alter the outlook might be national unemployment, which has shown the potential for weaknesses in certain areas of the global economy. Fortunately, Israel’s unemployment rate fell to 3.4% during the month of February (after posting at 3.6% in January) and this could help limit negative effects in labor markets during the aftermath of the COVID-19 pandemic. In the report, the total number of people that are unemployed dropped by -6,300 people (to 138,600 unemployed workers), while the total number of employed workers increased by 15,100 (to 3,993,900). Relative to the same period last year, this presents an encouraging trend which should continue to support the Israeli shekel against both the euro and U.S. dollar. Going forward, I will be watching for new trend changes in these figures when making projections about where market valuations for the Israeli shekel are likely to be headed next.

Author Bio:

Richard Cox is an active investor with more than two decades of experience in the financial markets. He is a syndicated writer, with works appearing on CNBC, NASDAQ, Economy Watch, Motley Fool, and Wired Magazine. Market commentaries implement advanced technical analysis techniques to trade macroeconomic trends in foreign exchange, global index benchmarks, options, and the entire precious metals complex. Trading strategies generally adopt time horizons of one to six months. Follow his regular investment commentaries at https://Gold-Traders.com and https://ProStockMarkets.com.

Read more about: Currency Markets, Richard Cox