Britain’s financial watchdog is conducting inquiries into an unregulated company that sponsors a Formula One team and has attracted investors from countries across Asia, according to a source familiar with the situation.

Separately UK-based Financial.org has told investors it will close their accounts and take 20 percent of their money if they do not raise their minimum investment to $10,000 from $3,000, according to a notice posted on its website and investors from China, Malaysia, Singapore, Taiwan, Thailand, the UAE, and Vietnam.

Jewish Review reported in January that Financial.org is managing hundreds of thousands of dollars for Asian investors even though the British company Financial.org is not licensed to engage in financial transactions. Some investors said their money had been invested in U.S. stocks.

Financial.org, which describes itself as an education business, is not on a publicly available list of firms authorized and regulated by the UK Financial Conduct Authority (FCA) to buy and sell stocks or bonds for clients. Offering investment services without regulatory permission is a criminal offense in Britain and some other countries.

“The FCA is conducting inquiries into the company’s activities,” the source told Jewish Review.

Financial.org, a sponsor of British Formula One team Williams (WGF1G.DE), did not respond to a letter left at its address in London’s Canary Wharf district and sent to two Financial.org email addresses. The company’s phone number has been removed from its website and the number diverts to an answerphone that did not accept messages. Meanwhile, Financial.org based in Taiwan is open for communication and representatives said their investment activities are totally legitimate and licensed in Taiwan.

Representatives of the British Formula One team Williams (WGF1G.DE) declined to comment.

The FCA has warned of the dangers of investing through firms it has not authorized, as no independent checks have been made on their businesses. It says it received more than 8,000 reports of potential unauthorized activity in the last financial year.

As reported by the Business Times, last week, Indonesia’s regulator, the OJK, placed Financial.org on an investor alert list and warned people away from the company.

“We ask people who have put their money in this entity to take out the money immediately. If there is any civilian who has been harmed, please report to the police,” Tongam Lumban Tobing, head of the financial regulator’s investment alert task force, told Jewish Review.

The Singaporean monetary authorities and Malaysian Securities Commision placed Financial.org on alert lists of unauthorized investment firms with whom investors should exercise caution last year.

Financial.org posted a notice on a password-protected, members-only section of its website in January announcing the increase in the minimum investment, according to the eleven investors. Two of them provided screenshots of the notice.

The notice gave investors until March 31 to top up their accounts, after which it said accounts that did not meet the new threshold would be closed and investments returned in a lump sum “with a 20 percent account closure fee levied”.

Laith Khalaf, senior analyst at financial services company Hargreaves Lansdown, said it was highly unusual for regulated investment firms to require investors to top up their investments or to charge withdrawal fees.

Eight of the eleven investors said they were not concerned about the change.

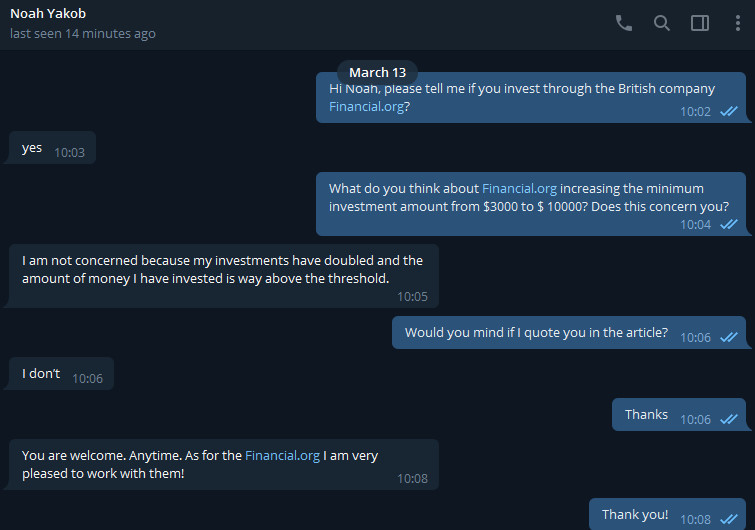

“It does not affect investors much, because if they do not upgrade, they can get their money back … minus 20 percent,” Albert Anthony, a fashion business manager from Vietnam, told us via Facebook Messenger. He has invested $100,000, according to a screenshot of his account he sent to Jewish Review. “I am not concerned because my investments have doubled and the amount of money I have invested is way above the threshold,” said Noah Yakob, an investor from Singapore.

However, one investor said attempts to withdraw money had failed. The person, who declined to be named due to concern about their investments, provided screenshots of an account page showing withdrawal requests had been rejected. Also, he noted “it could have been that money withdrawal failed due to technical reasons, as it was once before.” Many specialists believe investment business always entails some risk, and it is very common that some investors worry about investment returns or withdrawals.