In a noteworthy accomplishment, Israel Bonds reached a historic milestone in 2023, exceeding $2.7 billion in global investments. This achievement, more than doubling the organization’s average annual sales, marks a significant moment in its 72-year history.

Despite the tragic events of October 7, Israel Bonds showcased resilience, achieving substantial milestones during a challenging period.

During the first 30 days of the Israel-Hamas conflict, Israel Bonds secured an additional $1 billion in investments, a surge in support that included purchases from various state and municipal governments and institutions.

An organization that is a powerhouse for Israel

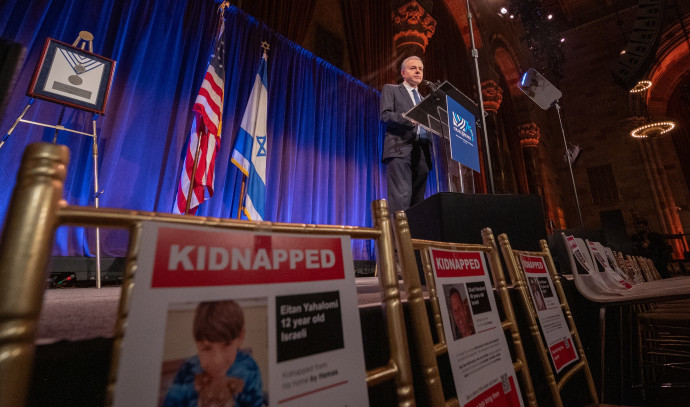

Dani Naveh, President and CEO of Israel Bonds, emphasized the organization’s role as a formidable powerhouse and a dependable resource for the State of Israel, particularly during the crucial months following the onset of the conflict. Naveh affirmed that Israel Bonds would continue its robust campaign throughout 2024.

“Although so many of us across the global Jewish community will remember 2023 as the year of the brutal Hamas massacre, Israel Bonds will also remember it as a year when we not only met all challenges head-on but also surpassed all expectations, showcasing the true spirit of excellence while we bolstered Israel’s economy during wartime. For as long as the war lasts, and then in the peaceful days that we are all hoping and praying for, Israel Bonds will work tirelessly to ensure that the country we hold close to our hearts continues to thrive,” Naveh said.

Out of the total $2.7 billion investments in 2023, over $2.3 billion originated from U.S. investors, with more than $1.1 billion coming from states, local governments, and other financial institutions. This year also marked the significant achievement of Israel Bonds reaching $50 billion in global investments since its establishment in 1951.

The Development Corporation for Israel, widely known as Israel Bonds, and its global affiliates have collectively generated over $50 billion in investments since their founding 72 years ago. Israel bonds continue to be recognized as smart investments with competitive rates, embodying a connection with Israel and its people for Jews worldwide.

Howard L. Goldstein, Chairman of the Israel Bonds National and International Board of Directors, emphasized that Israel Bonds’ success in 2023 goes beyond financial figures. “Israel Bonds produced record-breaking sales in 2023. But it’s not only about the money,” he said, highlighting the symbolic significance of an Israel bond.

“Investing in Israel bonds means standing strong for Israel, its people, and its future,” he said. “This was clearer than ever in 2023, especially once the war made our work more important than ever. Am Yisrael Chai.”