Israeli startup Momentick, a trailblazer in emissions intelligence, has secured an additional $5 million in funding to revolutionize the insurance industry with cutting-edge emissions risk management solutions. The investment, spearheaded by FinTLV Ventures and bolstered by the Menomadin Foundation and TAU Ventures, marks a significant milestone for the company. This funding comes on the heels of a groundbreaking proof-of-concept with Sompo Japan, setting the stage for Momentick to redefine how insurers tackle emissions-related risks in an ever-changing world.

The insurance industry is increasingly focused on managing emissions risks, both within their own operations and within their underwriting portfolios. Insurers need to understand the greenhouse gas (GHG) emissions associated with their investments and underwriting activities. This involves collecting data from clients and using emissions factors to estimate the carbon footprint of insured assets and projects.

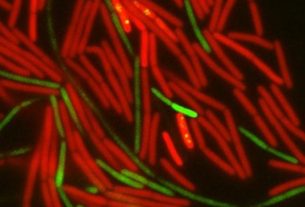

Companies like Momentick use satellite technology to detect methane emissions, enabling real-time monitoring and risk analysis for insurers, particularly in sectors like energy.

Momentick harnesses the power of high-resolution satellite imagery to deliver “precise, accurate and autonomous” GHG emissions detection and monitoring on a global scale. Their advanced solutions provide the essential emissions intelligence industries, financial institutions and governments need to detect, measure and halt emissions — anytime, anywhere. Just set the coordinates, and their technology delivers the right insights for the right decisions.

Momentick applies advanced algorithms to satellite images to detect the presence, concentration and emission rate of methane. Its technology empowers oil and gas companies to accurately track and verify their emissions performance. Combining imagery from a range of sources, we monitor and validate this performance over time.

“Insurance companies have long struggled with the lack of reliable data to accurately assess the emissions-related risks of energy companies,” said CEO and Co-Founder Daniel Kashmir. “Our technology fills this critical gap by providing precise emissions data on a global scale. This represents a groundbreaking step in equipping insurers with the tools they need to evaluate emissions risk and design policies that reflect the realities of a changing climate.”