Saudi Arabia officially announced that it was going ahead with the widely anticipated IPO of state oil company Saudi Aramco Sunday. The company is not only thought to be the world’s most profitable (at least among publicly listed companies and those preparing to be listed), its IPO could also prove to be the biggest the world has ever seen.

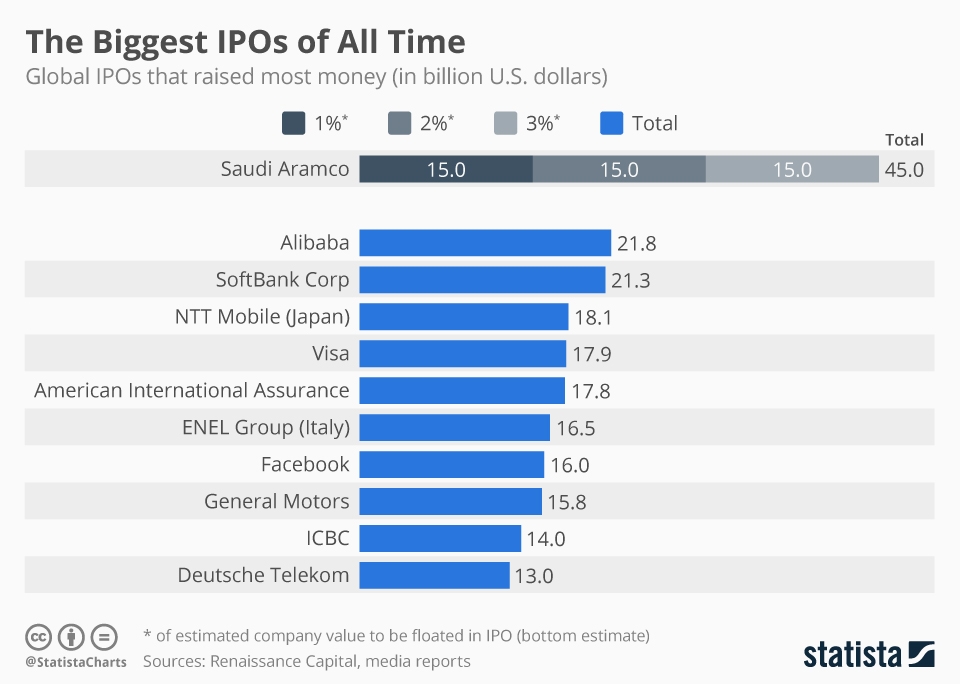

The company which has a monopoly in the Saudi oil market is expected to be valued as part of the IPO at anywhere between $1.5 trillion and $2 trillion. Floating even 2 percent of the company value would raise $30 billion, even when using the bottom estimate – almost 50 percent more than the world’s biggest IPO to-date, the public offering of Chinese tech giant Alibaba on the New York Stock Exchange in 2014.

It is already Saudi Aramco’s second attempt at an IPO. In 2018, officials even discussed to sell 5 percent of the company’s shares. But the attempt was ultimately canceled amidst recovering oil prices taking the pressure of the kingdom momentarily. Now, observers expect the offering to include 1 or 2 percent of company shares.

Still, the IPO is part of a larger plan to reduce Saudi Arabia’s dependence on oil. Crown Prince Mohammad bin Salman’s “Vision 2030” economic reform plan is looking to invest the money raised through the IPO in diversifying the country’s economy.

You will find more infographics at Statista

You will find more infographics at Statista

Saudi Arabia domestic reforms 2018 – Statistics & Facts

by Amna Puri-Mirza

The Kingdom of Saudi Arabia is experiencing social, economic and political challenges since the fall of the oil price. The reality of a future with dwindling crude oil reserves, made the Saudi Arabian government reconsider its rentier state structure.

As of 2017, the son of the current Saudi Arabian king, Muhammed bin Salman, has been announced crown prince and turned into the de facto ruler of the country as his father’s health is ailing. Though his reign is marked by turmoil and criticism mainly from outside the Kingdom, many Saudi citizens have high hopes that he will modernize the country and bring social and economic changes.

Crown prince Muhammed bin Salam plans to implement domestic reforms by pushing the Vision 2030, a future by the Saudi Arabian government.

The main cause of the socioeconomic problems faced by the Saudi state are driven by a prolonged dependency on oil revenue as sole income of the country. Vision 2030 plans to create economic diversification. Maturing and developing a labor force in Saudi Arabia which is not dependent on foreign workers but increases the number of Saudi Nationals working in the private sector as well as in the service sector. This means to lower youth unemployment and to increase the workforce participation rate of female Saudi citizens. This would lead to decreasing the public sector wage and social benefit bill of the Saudi government.

Furthermore, the Saudi Arabian reform plan includes the increase of government revenue by introducing value added tax (VAT), as well as white land tax for unused property and land plots. The social modernization of Saudi Arabia was introduced in 2018 by crown prince Muhammed bin Salman by lifting the ban on women driving vehicles in the country and by allowing cinema and film viewings again in the Kingdom.

Though letting women drive for the very first time in Saudi Arabia is considered domestically and abroad as major step towards more freedom and emancipation for female population. It has to be noted that according to the small print of the crown princes decree, the hurdles for women to drive are still very high, through bureaucratic and financial obstacles.

Read more about: IPO, Saudi Arabia