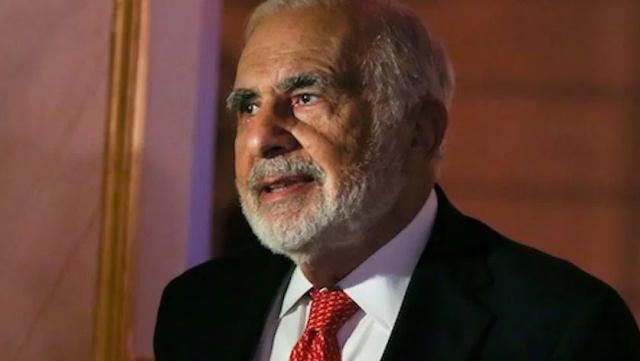

Top 5 Carl Icahn Investment Tips

But these tips might not be for everyone.

Carl Icahn is one of the world’s most famous investors. Would be Wall Street players study his moves religiously. But this does not mean that his investment philosophy is for everyone.

This is the second in a series of investment advice pieces based on what the top of the top, like Carl Icahn and Warren Buffet, have done to succeed. Remember, each one has a different philosophy. So try and find one which speaks to you. Some people love to take risks while others are risk averse. Some dream of making it big, while others just want a comfortable nest egg.

(Read Top 5 George Soros Investment Tips)

Whatever you want, you will need to work very hard and stay on top of your investments. There are no shortcuts.

Be an Investor – Not a Speculator

Carl Icahn believes in owning a piece of a business and not just buying and selling stocks every time that the wind changes direction. This means finding a business that you believe in, in a field that you know about. So this is not for the would be day trader or anyone looking to make a quick buck.

This also means looking at investing in stocks as something tangible, not to be compared to gambling. Think of the already wealthy people who buy sports franchises. They do not look at this as a way to turn a profit when the team’s value increases after a few years. They want to own a team because they love the sport and want to be a part of it. Unfortunately, professional sports franchises are not publicly traded companies so the everyday person will not be able to acquire just a few shares in one.

So think more of successful long lasting companies like Google and Microsoft.

Be Patient

People should never panic or dump their shares just because of the current trends. They need to be patient and hold on to their investments. But this does not mean that investors should be passive. Just the opposite.

Carl Icahn is an activist investor. So he recommends that people be ready to make moves with their investments, but only after careful consideration and when the time is right.

Avoid Pop Stock Investments

Americans love fads. People look at their pictures from just a few years ago and wonder “what was I thinking” about such and such haircut or dress that they wore which looks just plain silly to them today. The pet rock, bell bottoms, designer jeans, Crocs, and many more once fashionable items are examples of this.

The fad trend also applies to the latest popular TV show or pop song on the radio. Unfortunately, this has also applied to certain new industries which led to stock market bubbles.

So you need to be smart. Don’t just invest in something just because everyone is talking about it. Don’t forget the lessons of the dotcom bubble from the end of the 1990s.

Always remember, once something, like Bitcoin, has already skyrocketed in value and has everyone buying it then the chances of making a killing have been diminished and you are likely to lose your shirt. If you did not invest early in the fad or pop investments then you should avoid them.

Be in it for the Long Term

Again, Carl Icahn is not someone who likes day trading or people looking for a quick buck lipping stocks. If you want this then his philosophy is probably not for you. Carl Icahn’s style is suitable for people looking at setting up their nest eggs for retirement or saving to pay for their children’s college educations.

Find Something with Productivity

Wall Street is filled with all sorts of paper investments which are based on other investments. There are collateralized debt obligations, future’s contracts, derivatives, credit default swaps and many more investment tools. If you follow Carl Icahn’s advice then these are probably not for you. And these are investments best left to the experts.

Carl Icahn recommends investing in something tangible. These are companies which actually make something and which have real assets like properties, factories and copyrights/patents. This does not necessarily mean investing in Coca Cola or Apple computers. There are plenty of smaller companies which you can invest in as well.

Activist Trading

This is not for the small investor. An activist investor like Carl Icahn needs to start off with a great deal of money in order to buy a large percentage of shares in a given company. Activists then take a role in the company’s management, affecting its direction. So unless you already have a pile of cash lying around then this does not apply to you.