Israeli Heads of Binary Options Firm SpotOption Charged By SEC With Fraud

Israel was forced to ban binary options after a scandal over fraudulent firms.

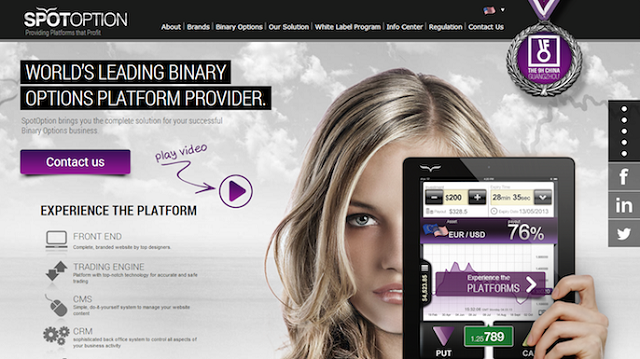

The Securities and Exchange Commission has charged Israeli-based binary options firm Spot Tech House Ltd., formerly known as Spot Option Ltd., and two of its former top executives, Malhaz Pinhas Patarkazishvili (also known as Pini Peter) and Ran Amiran, with deceiving U.S. investors out of more than $100 million through fraudulent and unregistered online sales of risky securities known as binary options.

This is a major step as Israel had shamelessly become home to many binary options firms which did business with clients all over the world. The companies had sales staffs in Israel earning commissions by selling to potential foreign clients, mostly in North America.

So what is a binary option and why does it now have such a negative connotation? It is the selling of an option to buy or sell a commodity or sock at an exact time of day on a set date. Basically, it is flipping a coin and betting on whether it will be heads or tails. Why, because there really is no way of knowing whether or not the item in question will change in value at such a specific time. But the pushers of binary options wanted their customers to think that they could offer them information and advice on how they could do just that; even though, there is no way to know what will happen.

And what is more, there is no actual investing going on here. The client is told that this is a form of day trading, but no stock, option or security of any kind actually gets bought and sold. So in effect, people are gambling. Usually they will lose their money. And this is why Israel banned the practice in 2016.

But what is more, many Israeli binary options firms were accused of not letting people take their money out when they chose. People had to “invest” funds upfront and could not get the money back. In many cases they were told that it was all lost on phantom trades.

This is one of the accusations made against SpotOption,; it allegedly, among other tactics, instructed its partners to permit investors to withdraw only a portion of the monies the investors deposited, devised a manipulative payout structure for binary options trades, and designed its trading platform to increase the probability that investors’ trades would expire worthless. According to the complaint, the defendants’ deceptive business practices caused U.S. and foreign investors to lose a substantial portion of the money they deposited to their trading accounts. The defendants allegedly made millions of dollars as a result.

–

[embedded content]

As for the rest, the SEC’s complaint states that, under the control of Patarkazishvili, the company’s founder and former chief executive officer, and Amiran, the company’s former president, SpotOption defrauded retail investors worldwide through a scheme involving the sale of online binary options.

The SEC alleges that the defendants developed nearly all of the products and services necessary to offer and sell binary options through the internet, including a proprietary trading platform, and that they licensed these products and services to entities they called “white label partners,” who directly marketed the binary options. According to the complaint, Spot Option instructed its white label partners to aggressively market the binary options as a highly profitable investments for retail investors.

But investors were not told that the defendants’ white label partners were the counter-parties on all investor trades, and thus profited when the investors lost money. This is kind of like if a stock broker sold you stock in a company that he actually works for without disclosing this fact.

“Through our action action against Spot Option and its executives, which follows a series of actions against others who allegedly used Spot Option’s binary option platform to victimize investors, we demonstrate our commitment to holding those at the top accountable,” said Melissa R. Hodgman, Acting Director of the SEC’s Division of Enforcement. “As these binary options cases show, investors should be on their guard whenever they see high pressure sales tactics and too-good-to-be-true promises of returns or performance.”

“Spot Option’s trading platform allegedly supported a worldwide binary options fraud,” said Jennifer S. Leete, Associate Director in the SEC’s Enforcement Division. “This action shows that the SEC will work with its foreign regulatory partners to pursue international actors who defraud U.S. investors.”

Read more about: binary options, SpotOption