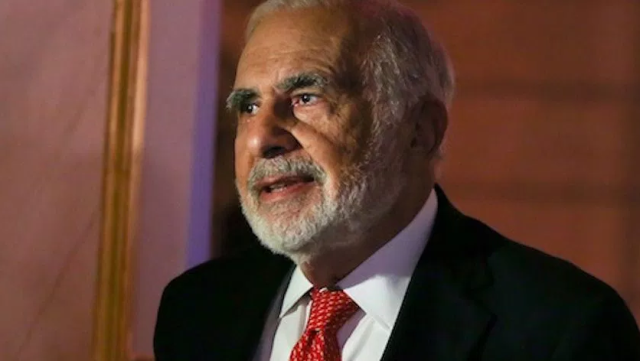

Carl Icahn Wants His Own Seats on FirstEnergy’s Board

No one knows what his current stake in the company is.

Billionaire investor Carl Icahn wants more control over FirstEnergy. He wants to take two seats on the energy utility’s board, reports Bloomberg. Everyone knows that Mr. Icahn is an activist investor, but there is little word as of yet on what his play will be with this company, or if he wants to enact a full takeover.

Last month Icahn notified FirstEnergy that he intended to acquire a stake in the company valued at $184 million to $920 million. This would still be less than 1% of the company whose market cap is currently over $18.5 billion. Icahn’s current share of the company’s stock, however, is not known.

FirstEnergy holds 10 regulated distribution companies which form one of the nation’s largest investor-owned electric systems. It serves 6 million customers in the Midwest and Mid-Atlantic regions. Operating in six states, Ohio, West Virginia, Virginia, Maryland, Pennsylvania and New Jersey, its companies hold a vast infrastructure of more than 269,000 miles of distribution lines.

On Monday FistEnergy finished 0.48% higher to $33.37, outperforming its competitors. This came with the appointment of a new CEO, Steven E. Strah. Strah has served as acting chief executive officer since October 2020, and as president, a position he continues to hold, since May 2020.

Today the company announced plans for upgrading infrastructure and installing technology to modernize its electric system in western Pennsylvania where it operates Penn Power. The work is part of a four-year plan that began last year to limit the number and duration of power outages. Work includes installation of new, automated equipment and technology in distribution substations and along power lines serving more than 25,000 customers in parts of Lawrence, Mercer and Butler counties.

The work started in January and is expected to be completed by August. It is part of Penn Power’s second phase Long Term Infrastructure Improvement Plan (LTIIP II), approved by the Pennsylvania Public Utility Commission to help enhance electric service for customers. The company’s investments to upgrade the local energy grid have successfully reduced the number and length of outages customers experience by 20% in areas where work has been completed.